Housing Perspective - 2025 Housing Market Outlook

The California housing market had a rough start for the year as mortgage rates extended their upward trend in the first two weeks of 2025 and devastating wildfires in Southern California destroyed thousands of homes. Statewide home sales pulled back in January and reached their lowest level in 13 months and the 10% month-to-month decline was the biggest dip in 30 months. Open-escrow sales in January also dipped from their year-ago level and had the largest year-over-year decline in 14 months.

Despite kicking the year off with a soft note, home sales should begin to pick up once we enter the spring homebuying season. While mortgage rates remain near their highest level since last July, they have trended down in the past four weeks since reaching their recent peak. Interest rates will likely moderate later this year but policy uncertainty and concerns about tariffs could keep inflation from easing, which could make it more difficult for rates to come down. However, with rates remaining elevated since late 2022, many buyers and sellers begin to accept the reality that rates are not going back to 3%, and the prevailing rate level could be the new norm. As such, assuming that the economy stays healthy in 2025, California should see an increase in housing demand in the next 12 months.

On the supply side, while the mortgage lock-in effect is still in place, it is expected to loosen up further this year. More properties will be released as more homeowners, who have been putting off their home trading plans in the past few years, decide to get back to the market. California, in fact, is already seeing an increase in housing inventory at the start of the year, as new active listings at the state level jumped at the sharpest year-over-year growth rate in 45 months in January. As the housing market gears up for the spring homebuying season, new active listings should continue to grow in coming months. While supply this year will still remain below the norm by historical standards, active listings are expected to increase by more than 10% if market conditions stabilize and the lending environment continues to improve.

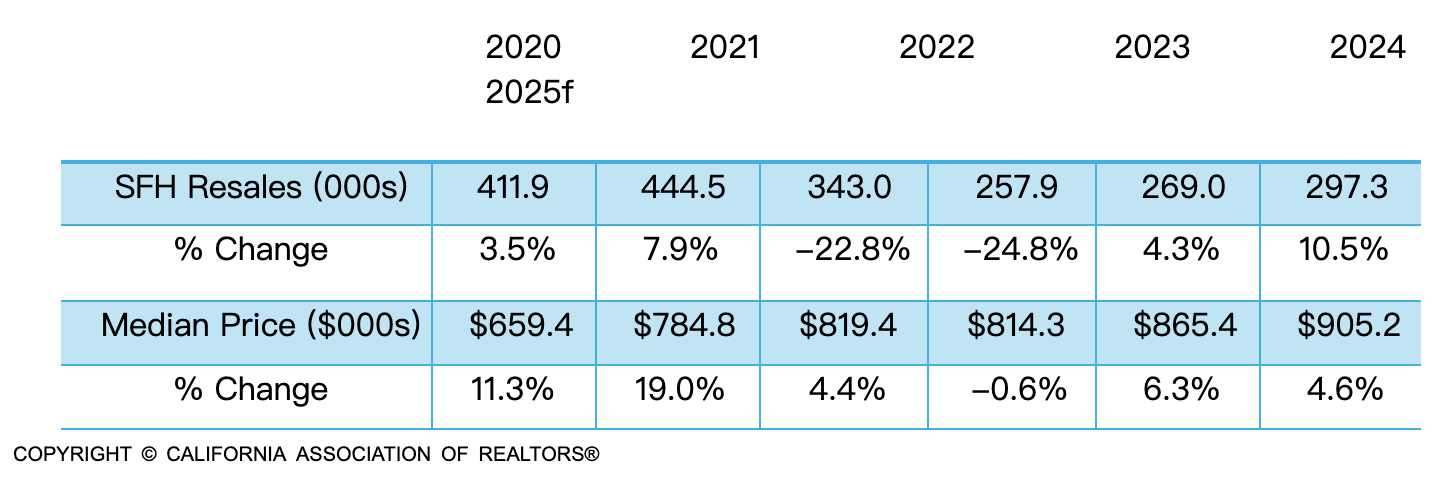

The increase in for-sale properties will help bring more balance between supply and demand back to the market. Nevertheless, supply will remain tight by historical standards and the shortage will continue to apply upward pressure on home prices. In January, the statewide median price climbed again on a year-over-year basis and the gain recorded last month was slightly higher than the 6-month average observed between July 2024 and December 2024. The acceleration in price growth is an indication that further price gains could be observed in the coming months. Assuming a mild decline in rates in 2025, home prices should rise moderately with the state’s median price climbing 4.6% to $905,200.

California Housing Market Outlook

Hey! I am author...

哈囉,我是地產小王子 William,來美國已經快30年。

一路走來,我最早的專業是會計,畢業後曾在銀行做放款,也曾為私人企業老闆做大掌櫃。

真正讓我下定決心走進房地產這一行,是因為幫老闆管帳,看到他的稅表我整個驚呆了——原來房地產可以做到這個程度?我開始好奇:為什麼這麼多人選擇透過地產來創造財富?這一行到底藏著什麼樣的邏輯與機會?

也就是從那時開始,我踏入了這條充滿策略與可能性的路。

目前擔任 加州地產協會(C.A.R.)理事,同時也是 West San Gabriel REALTOR® Association 與 洛杉磯台美商會 理事,深耕南加州地產圈與社區多年。

歡迎參加免費線上講座

《稅務處分物件 投資入門說明會》

We have built our reputation as true local area experts.

2024 © Rhinostone Capital Group Corp.